Schlagwörter

Aktuelle Nachrichten

America

Aus Aller Welt

Breaking News

Canada

DE

Deutsch

Deutschsprechenden

Global News

Internationale Nachrichten aus aller Welt

Japan

Japan News

Kanada

Karte

Karten

Konflikt

Korea

Krieg in der Ukraine

Latest news

Map

Maps

Nachrichten

News

News Japan

Polen

Russischer Überfall auf die Ukraine seit 2022

Science

South Korea

Ukraine

Ukraine War Video Report

UkraineWarVideoReport

United Kingdom

United States

United States of America

US

USA

USA Politics

Vereinigte Königreich Großbritannien und Nordirland

Vereinigtes Königreich

Welt

Welt-Nachrichten

Weltnachrichten

Wissenschaft

World

World News

12 Kommentare

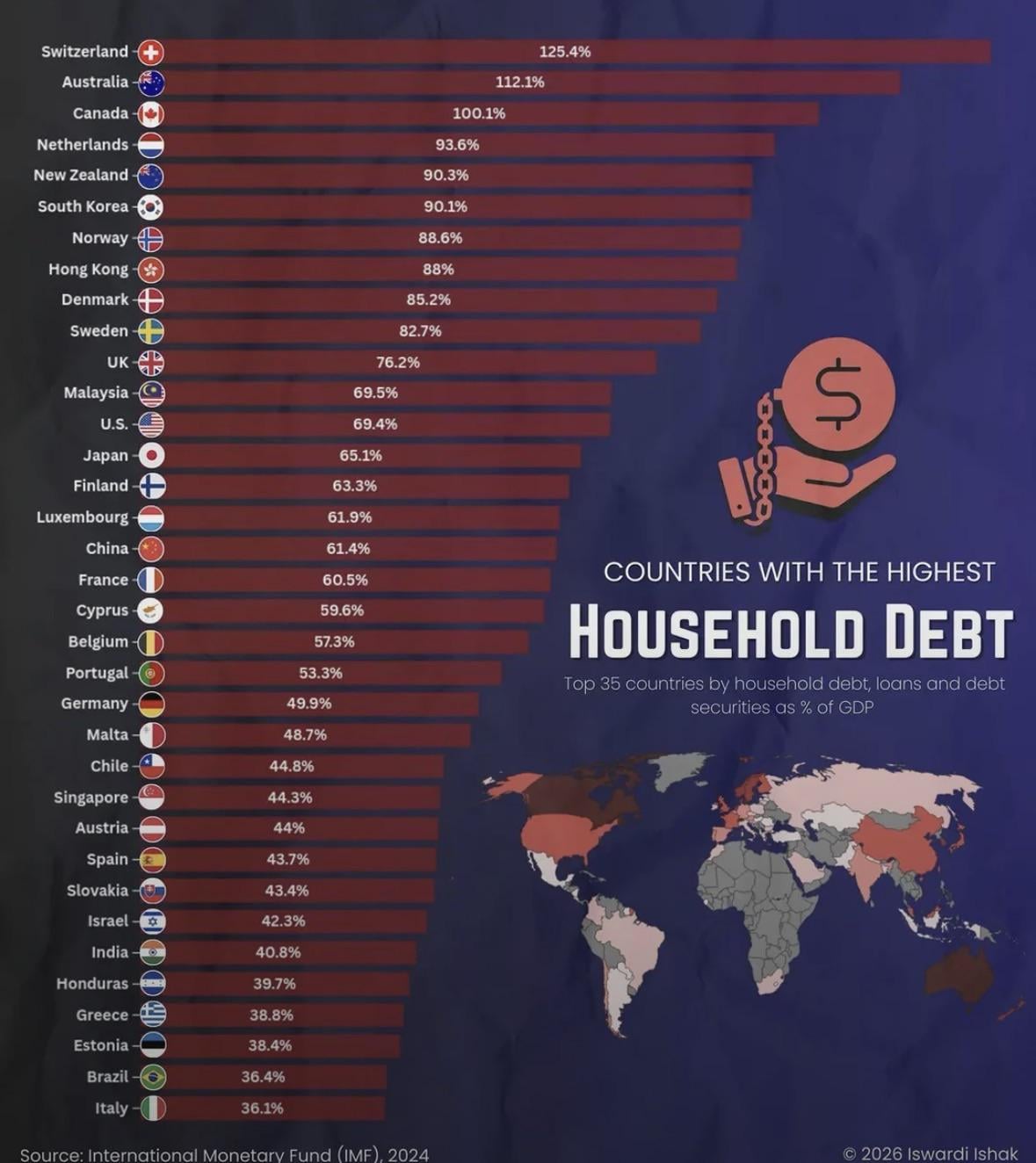

Also because we don’t pay down principals on our mortgages?

lol, it’s kinda ironic because we like to think of ourselves as financially responsible so much.

How is it possible in a country where 60+% don’t even own a home?

Yay! Switzerland #1, oh wait…🤦🏼♂️

yes this is definitely mostly due to mortgages and tax advantages of higher debt. It is less of a big deal as in most countries due to the asset backed nature of the debt, low inflation and correspondingly relatively low interest rates.

In retrospect, I realise we have very high household debt. However, the only debt we have is CHF margin loan because the rate is around 1% and we earn salary in CHF so we have no currency risk.

I want to see how much of that is housing. Not saying that isn’t debt but it would be informative. This doesn’t tell you who is borrowing irresponsibly. It just tells you that housing is expensive.

I’d love to be chained down to a property kn Switzerland. May this life find me. Bless amen

> That’s good, right? Right?!

Well, that’s because imputed rental value is taxable income, mortgage interest is fully tax-deductible and wealth tax favors debt.

My own house is 110 % financed even though I could buy it easily with the money in my trust. I don’t do that, so I save on wealth tax. Also, I can use the saved equity for real investments

In the news: people living in the country with the lowest interest rate on Earth borrow money.

[https://tradingeconomics.com/country-list/interest-rate](https://tradingeconomics.com/country-list/interest-rate)

The higher debt countries is all mortgage related. Especially CH where interest rates are really low and house prices are exploding

It looks scary, but this isn’t „bad debt“ (like credit cards); it’s mostly strategic mortgage debt.

Here is why being #1 here is actually a structural quirk, not a crisis:

The Tax Trap (Imputed Rental Value): Switzerland has a unique tax rule where homeowners are taxed on the „theoretical rent“ they save by living in their own house. You are literally taxed on income you don’t earn.

The Loophole: To offset this tax, you are allowed to deduct mortgage interest from your taxable income.

The Strategy: Because of points 1 and 2, paying off your house is a financial mistake. If you pay off your debt, your taxes go up significantly. So, people keep mortgages forever on purpose.

High Net Worth: Swiss households usually have the cash to pay off this debt (in pension funds/savings), but they choose not to because the tax incentives to stay in debt are too strong

TL;DR: In Switzerland, the system is designed so that being in debt is cheaper than being debt-free. It’s tax optimization, not people running out of money.